Combining Generosity and Security: Understanding Charitable Gift Annuities

A charitable gift annuity (CGA) is a powerful financial tool that combines philanthropy with financial security. It allows you to support a charitable organization while receiving a steady stream of income for life. For individuals who want to give back while ensuring personal financial stability, charitable gift annuities offer a unique and mutually beneficial solution.

What is a Charitable Gift Annuity?

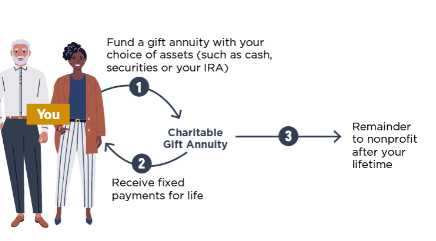

A charitable gift annuity is a contract between a donor and a nonprofit organization. The donor makes a significant donation to the charity, and in return, the charity agrees to pay the donor (or a designated beneficiary) fixed, regular payments for the rest of their life.

After the donor’s lifetime, the remaining funds are retained by the charity to support its mission.

How Does a Charitable Gift Annuity Work?

- The Donation

- The donor contributes a gift of cash, securities, or other assets to the charity.

- The minimum gift amount varies but often starts around $10,000.

- Annuity Payments

- The charity pays the donor (or another named recipient) a fixed income for life.

- Payments are determined based on the donor’s age at the time of the gift—older donors typically receive higher payout rates.

- Remainder Gift

- After the donor’s passing, any remaining funds go to the charity to support its programs and initiatives.

Benefits of Charitable Gift Annuities

- Guaranteed Income for Life

A CGA provides financial security by offering fixed payments, regardless of market fluctuations. - Tax Advantages

- Immediate Tax Deduction: Donors may qualify for a charitable income tax deduction at the time of the gift.

- Partially Tax-Free Payments: A portion of the annuity payments is often tax-free, as it’s considered a return of the donor’s original gift.

- Capital Gains Relief: Donors contributing appreciated assets, such as stocks, can reduce capital gains taxes.

- Supporting a Cause You Love

By establishing a CGA, you provide long-term financial support to a charity, ensuring your gift contributes to its mission for years to come. - Legacy Creation

A CGA is a meaningful way to leave a lasting legacy, reflecting your values and commitment to making a difference.

Who Should Consider a Charitable Gift Annuity?

Charitable gift annuities are ideal for:

- Individuals Seeking Financial Security: Those who want a steady income in retirement while supporting a cause.

- Philanthropically-Minded Individuals: Donors who wish to make a substantial contribution to charity.

- Older Donors: Individuals over 60 typically receive higher annuity rates, making CGAs an attractive option for seniors.

- People with Appreciated Assets: Those with stocks or property that have increased in value can reduce their tax burden while donating.

How Annuity Rates Are Determined

Annuity payment rates are influenced by:

- Age of the Donor: Older donors receive higher payout rates due to a shorter life expectancy.

- Gift Amount: The size of the donation determines the total annuity payments.

- Charity Guidelines: Many charities follow rate recommendations from the American Council on Gift Annuities (ACGA) to ensure fair payouts.

Example of a Charitable Gift Annuity

Let’s say a 70-year-old donor contributes $50,000 to a nonprofit in exchange for a CGA. Based on the current rate of 5.1% for their age:

- The donor will receive $2,550 annually for life.

- Part of this income will be tax-free for a specified period.

- The donor qualifies for a charitable tax deduction, potentially saving thousands in taxes.

- After the donor’s passing, any remaining funds will benefit the charity’s programs.

Considerations and Risks

- Irrevocable Gift

Once a CGA is established, the gift cannot be withdrawn or refunded. - Charity’s Financial Stability

Annuity payments depend on the charity’s ability to manage its financial obligations. Donors should research the organization’s stability before entering into an agreement. - Not Suitable for Short-Term Needs

If you require immediate access to your assets or greater liquidity, other charitable giving methods may be more appropriate.

How to Establish a Charitable Gift Annuity

- Choose a Charity

Select a nonprofit organization that aligns with your values and is qualified to offer CGAs. - Review Your Financial Situation

Consult a financial advisor or tax professional to ensure a CGA fits your overall financial and philanthropic goals. - Determine the Asset to Donate

Decide whether to contribute cash, securities, or other assets, and assess the tax implications of your gift. - Sign the Agreement

Work with the charity to finalize the CGA contract, specifying the donation amount and payment terms.

Conclusion

A charitable gift annuity is a powerful way to combine generosity with financial security. It provides a steady income for life, significant tax benefits, and the satisfaction of supporting a cause you care about. Whether you’re planning for retirement or looking to leave a meaningful legacy, a CGA is a mutually beneficial option worth exploring.

Take the first step by connecting with a nonprofit organization that offers CGAs and consulting with a financial professional. With a charitable gift annuity, you can give back while securing your financial future.

Also Read :

Leave a Comment