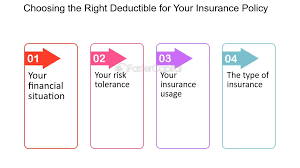

How to Choose the Right Deductible for Your Insurance Policy

Choosing the right deductible is a key decision when selecting an insurance policy. A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. This applies to various types of insurance, including health, auto, home, and renter’s policies. The right deductible impacts both your monthly premium and your out-of-pocket expenses, so it’s essential to make a well-informed choice. Here’s a guide on how to choose the deductible that aligns with your financial situation and coverage needs.

1. Understanding How Deductibles Work

Before deciding on a deductible, it’s important to understand the role it plays in your insurance policy. Deductibles are designed to share the cost between you and the insurance company. When you select a higher deductible, you agree to pay more upfront for any claims, but you’ll often pay lower premiums each month. Conversely, a lower deductible means that the insurance company will cover more of the costs, which usually results in higher monthly premiums.

Types of Deductibles by Insurance Type

- Health Insurance: Deductibles vary by policy and affect how much you pay for healthcare services before insurance contributes.

- Auto Insurance: Often includes a deductible for collision and comprehensive coverage.

- Homeowners/Renters Insurance: Applies to claims involving property damage, theft, and other covered incidents.

2. Assess Your Financial Situation

A key factor in choosing the right deductible is your financial ability to handle unexpected costs. Here are a few questions to help assess this:

- How much can you afford to pay upfront in the event of a claim?

- Do you have an emergency fund that could cover a high deductible if needed?

- Would a higher deductible put a strain on your finances?

If you have savings or an emergency fund that can comfortably cover a higher deductible, opting for a higher deductible could be a good choice. However, if an unexpected bill would create financial hardship, a lower deductible might be the safer option.

3. Weighing Premiums Against Deductibles

The general rule is that higher deductibles equate to lower premiums, while lower deductibles result in higher premiums. Here’s how to weigh this balance:

- High Deductible, Low Premium: Ideal for those who rarely make claims and want to reduce monthly expenses.

- Low Deductible, High Premium: Better for individuals who anticipate frequent claims or prefer the security of lower out-of-pocket expenses.

Calculate the annual premium savings of a high-deductible plan versus a low-deductible plan and consider whether those savings outweigh the increased out-of-pocket cost in case of a claim.

4. Estimate Potential Claim Frequency

Your likelihood of filing claims can greatly affect which deductible is best for you. Think about your specific needs for each type of insurance:

- For Health Insurance: If you visit the doctor frequently, have chronic conditions, or need regular prescriptions, a lower deductible may be more beneficial.

- For Auto Insurance: If you drive in high-traffic areas or have a lengthy commute, the odds of an accident may increase, making a lower deductible advantageous.

- For Home Insurance: If you live in an area prone to natural disasters or in a home with older systems, a lower deductible could be more protective.

By evaluating the likelihood of making a claim, you can better decide on a deductible that will minimize your overall expenses.

5. Look at Your Risk Tolerance

Your comfort with financial risk plays a major role in selecting a deductible. A high-deductible plan means you’re willing to take on more out-of-pocket risk in exchange for saving on premiums. If this makes you uncomfortable, consider a low-deductible plan that reduces your immediate financial responsibility but raises your monthly premium.

6. Consider Policy-Specific Deductible Options

Certain insurance policies offer a variety of deductible options that can affect the cost and coverage limits:

- Deductibles for Comprehensive vs. Collision Coverage: In auto insurance, you can often set different deductibles for comprehensive (non-collision incidents) and collision (accidents) coverage.

- Per-Claim vs. Annual Deductibles: Health insurance usually has annual deductibles, while auto and homeowners insurance may have per-claim deductibles. Consider whether a per-claim deductible would be more costly in the event of multiple claims.

7. Calculate Your Long-Term Costs

Look beyond the monthly premium and deductible to the bigger picture:

- Projected Annual Costs: Estimate your total annual costs with each deductible option by adding the yearly premiums to the deductible amount for one or more claims.

- Break-Even Analysis: If the savings in monthly premiums outweigh the higher deductible by a large enough margin, a higher deductible may make sense. For example, if choosing a $1,000 deductible saves $300 in annual premiums over a $500 deductible, it might be worthwhile if you don’t expect frequent claims.

8. Evaluate Any Deductible Waiver Options

Some policies offer a deductible waiver in certain situations, such as accident forgiveness for safe drivers or health insurance perks for completing wellness programs. These features can influence your choice of deductible by adding extra value to the policy.

9. Review Your Insurance Policy Regularly

Insurance needs can change with major life events, such as buying a new home, getting married, or having children. Make it a habit to review your policy and deductible choices every couple of years to ensure they still meet your needs.

10. Consult with Your Insurance Agent

If you’re unsure about which deductible is best, consult with an insurance agent or financial advisor. They can help analyze your options, explain the policy’s details, and make recommendations based on your unique financial situation and risk tolerance.

Conclusion

Choosing the right deductible for your insurance policy requires balancing your financial comfort with your risk tolerance. By understanding how deductibles impact premiums, assessing your ability to cover out-of-pocket expenses, and considering your claim frequency, you can make an informed decision that aligns with your budget and peace of mind. Regularly reviewing your choices and consulting with an expert can also help you stay on track as your financial and insurance needs evolve.

Leave a Comment